Start 14-Day Trial Subscription

*No credit card required

China Beer Market Outlook: Consumer Demand Leads to Growth

In a recent report from Fitch Solutions Macro Research (a unit of Fitch Group), consumer demand for beer in China has grown and is "being driven by the country's young, middle income consumer segment, with the tier one cities of Beijing, Shanghai and Tianjin offering the greatest volume of this consumer group, as well as large numbers of bars and restaurants for the distribution of more premium alcohol offerings," according to the report.

Competition in the country is also set to increase with Heineken taking a 40% stake in the government-controlled China Resources Beer Holdings Co. earlier this month.

The full report from Fitch Solutions is below, outlining the growth in China's beer market.

Industry Trend Analysis - Heineken Looks To Strengthen Foothold In China's Premium Beer Market

Key View: The increasing demand for more premium beer offerings in China is being driven by the country's young, middle income consumer segment, with the tier one cities of Beijing, Shanghai and Tianjin offering the greatest volume of this consumer group, as well as large numbers of bars and restaurants for the distribution of more premium alcohol offerings. Competition in the Chinese premium beer segment is now set to increase further with Heineken inking a strategic partnership with domestic beer manufacturer China Resource Beer (CR Beer).

What Are The Drivers Of The Beer Premiumisation Trend In China?

- Spending on alcohol in China is set to record the strongest growth globally, with spending on per capita terms forecast to increase by 54% over the medium-term period (2018-2022) and projected to reach USD46.4 per annum by 2022. In comparison, alcohol consumption in litres will only increase by 7% over this forecast period.

- Beer will remain the alcohol of choice for Chinese consumers, with consumption dominating the alcoholic beverage mix, but consumption decreasing as consumers trade up price points. We project Chinese beer consumption to decrease by 4% over the medium-term (2018-2022) from a projected 36.9 litres per capita in 2018 to 35.4 litres in 2022 as consumers on average start to spend more but consume less.

Premiumisation Driving Demand For Higher-End Alcohol

- Expanding young and middle-class consumer segment is set to drive the demand for more premium product offerings. Chinese households with a disposable income of USD35,000 and over per annum are projected to expand from 12.8mn in 2018 to 32mn in 2022. In 2018 we project that the percentage of the Chinese population within the young adult segment (20-39 year old) will stand at 29.6%.

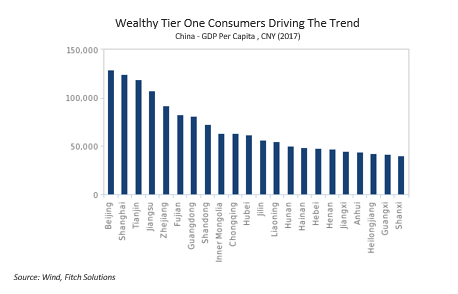

- Tier one city consumers will drive the trend. Consumer located in China's Tier One cities will initially be the drivers of the premium beer trend in the country, not only because they boast the earnings level to afford more premium offerings, as these cities offer the wealthiest consumers in China, GDP per capita of CNY128,900 in Beijing, CNY124,600 in Shanghai and CNY119,200 in Tianjin.

This material is protected by international copyright laws, and use of this is subject to our Terms & Conditions. © 2018 Business Monitor International Ltd

Wealthy Tier One Consumers Driving The Trend

Source: Wind, Fitch Solutions

Latest Development

Heineken will take a 40% stake in the government-controlled China Resources Beer Holdings Co. (CR Beer), maker of the popular domestic Snow brand, for a USD3.1bn investment. As part of the deal, Heineken will sell its Chinese business to the brewer for USD305mn and the Chinese company will license the Heineken brand domestically.

For Heineken, investing in CR Beer will allow the Dutch brewer to utilize the Chinese group’s local distribution network to expand its footprint in the Chinese market. Currently Heineken, in addition to its eponymous brand, also sells international brands Tiger and Sol, along with cheaper local brands Anchor and Hainan Beer. The beer major has however to date struggled in China due to the difficulty in building a nationwide supply network, with the company reporting volume declines in China in FY17 (ending December 2017). This has continued into 2018, with Heineken’s volume growth in China coming in at just 1% in H118 according to the Financial Times.

Competitive Landscape

For CR Beer, a partnership with Heineken will enable the former to add international premium beer to their existing portfolio, tapping into the growing premiumisation trend in China as consumers move up the price point and purchase higher-end alcohols. CR Beer will also be able to leverage on Heineken’s global distribution network to expand the presence of the Snow Beer brand into overseas markets.

Heineken's stake in CR Beer will place it on a stronger footing to compete with Budweiser in China. AB InBev has steadily expanded its Budweiser label in China, with AB InBev reporting 18.6% share in the Chinese beer market in 2016. AB InBev has also been making inroads into China's craft beer sector acquiring Boxing Cat Brewery in Shanghai in March 2017 and its venture capital division ZX Ventures opened a new brewery in Wuhan in February 2018 to produce beer its leading craft beer brands - Goose Island, Boxing Cat and Kaibu. Other international beer majors in China are Carlsberg, which has relied on its control of a local brewer, Chongqing Brewery Co. to build up its presence in China.

A cautionary tale for Heineken as it seeks to expand its premium beer offerings in China is Japan’s Asahi, which sold its 20% stake in China’s Tsingtao Beer, a leading brewer in China, in December 2017 after struggling to push its higher-end beer brand Super Dry in the Chinese market.