Start 14-Day Trial Subscription

*No credit card required

Indian Beer Market Set for Strong Growth in 2018

According to BMI Research of Business Monitor International, the beer market in India is set for strong growth in 2018 after years of upticks in beer sales. According to the release, "on the back of changing cultural attitudes and a young, increasingly affluent population, demand for premium and craft beers is rapidly emerging."

The full report from BMI Research is below, which details the growth in beer sales in India over the past 10 years.

Industry Trend Analysis - Nascent Indian Beer Market Picks Up Steam

BMI View: We continue to hold a favourable outlook for the beer market in India on the back of changing cultural attitudes and a young, increasingly affluent population. Demand for premium and craft beers is rapidly emerging, further supporting our positive growth outlook. We caution however that this growth is coming from a low base, and government regulations and hike in duties remain a risk to India's developing beer market.

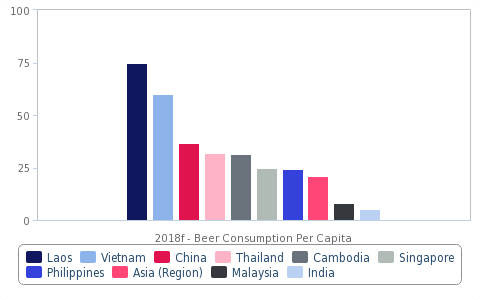

Despite a large consumer base and youthful demographics, India's beer market has, until now, been slow to take off. India has one of the lowest levels of beer consumption per capita in Asia. We estimate total alcohol consumption at 5.1 litres per capita in 2018, considerably lower than the regional average of 20.9 litres per capita. Conservative attitudes, licensing regulations, restrictions on the sale of alcohol in certain states and a preference for locally produced spirits such as whiskey are key reasons for the slow development of India's beer market.

India's Beer Growth Will Come From Low Base

Selected Asian Countries - Beer Consumption, Litres Per Capita

f= BMI forecast. Source: BMI

However, we noted in early 2017 that the Indian beer market was gaining momentum, and we continue to project significant long-term growth opportunities in the market (see 'Indian Beer Market Gaining Momentum', January 5 2017). At a time when global brewers are looking to reduce reliance on saturated developed markets by expanding their reach and product offering in fast-growing emerging markets, we believe India will increasingly become a strategic area of focus for companies such as Heineken and AB InBev.

Recent developments support this view. According to media reports, Heineken is aiming to boost its presence in the Indian market by buying another 15% stake in the country's largest brewer, United Breweries, which will give the Netherlands-based brewer majority control (already holds a 44% stake). United Breweries has also announced plans to launch its first craft beer brand in India by the end of 2018.

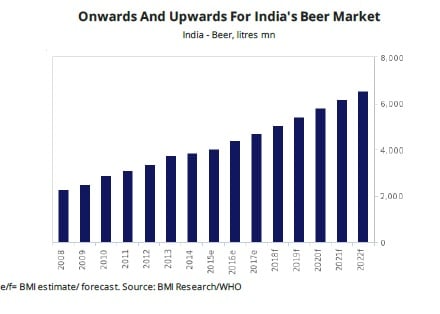

We forecast beer sales in volume terms to grow by an average of 6.9% annually between 2018 and 2022, reaching 6.5bn litres in total by the end of this period, up from an estimated 4.7bn litres in 2017.

Onwards And Upwards For India's Beer Market

Three key factors driving growth:

Burgeoning Middle Class – We estimate the share of households falling into the middle-income segment (household disposable income of USD10,000+) to account for 25% of households in 2022, up from 11% in 2018. Rising disposable incomes will lend support to greater discretionary spending and spending on alcoholic drinks, in particular for beer as Indian consumers pursue more aspirational lifestyles, locally produced spirits are cheaper and more widely accessible and so don't hold the same aspirational image.

Burgeoning Middle Class – We estimate the share of households falling into the middle-income segment (household disposable income of USD10,000+) to account for 25% of households in 2022, up from 11% in 2018. Rising disposable incomes will lend support to greater discretionary spending and spending on alcoholic drinks, in particular for beer as Indian consumers pursue more aspirational lifestyles, locally produced spirits are cheaper and more widely accessible and so don't hold the same aspirational image.

Changing Attitudes Among Young Urban Consumers – Attitudes towards alcohol are evolving, particularly among young urban-dwellers who are gaining an appetite for beer, as a drinking culture becomes more popular in major cities like Mumbai, Delhi and Bangalore. 33% of the total population in India is made up of millennials (aged 20-39 years old) according to our 2018 projections, which will help boost beer consumption, as drinking increasingly becomes part of social interactions. We expect major brewers to continue to focus expansion among urban millennials as a result.

Changing Attitudes Among Young Urban Consumers – Attitudes towards alcohol are evolving, particularly among young urban-dwellers who are gaining an appetite for beer, as a drinking culture becomes more popular in major cities like Mumbai, Delhi and Bangalore. 33% of the total population in India is made up of millennials (aged 20-39 years old) according to our 2018 projections, which will help boost beer consumption, as drinking increasingly becomes part of social interactions. We expect major brewers to continue to focus expansion among urban millennials as a result.

Emerging Craft Beer Culture – Influenced by trends from Europe and the US, India is rapidly developing its own craft beer culture with notable companies such as B9 Beverages’ Bira 91 and White Rhino popular among Indian consumers. Although India’s craft beer industry is still nascent, the All India Brewers Association estimates craft beers sales to be growing at a rate of 20% y-o-y.

Emerging Craft Beer Culture – Influenced by trends from Europe and the US, India is rapidly developing its own craft beer culture with notable companies such as B9 Beverages’ Bira 91 and White Rhino popular among Indian consumers. Although India’s craft beer industry is still nascent, the All India Brewers Association estimates craft beers sales to be growing at a rate of 20% y-o-y.

India’s beer market is dominated by United Breweries (of which Heineken currently has a 44% stake) which controls over half of the market on the back of its

Kingfisher brand. However, Carlsberg and AB InBev are providing increasing competition with both looking to strengthen their market share in the country. AB

InBev, which operates as Crown Beers India Ltd, has been rolling out its Budweiser brand into second and third-tier cities in India since mid-2017. AB

InBev's beer portfolio in India also includes local favourite Haywards 5000 (previously owned by SABMiller), and more premium global brands such as Foster's, Stella Artois, Hoegaarden and Corona. Carlsberg's presence in the market is through its Tuborg and flagship Carlsberg brands. Entering the premium category, Carlsberg India launched its Tuborg Classic, a premium strong beer with Scotch Malts in April 2017.

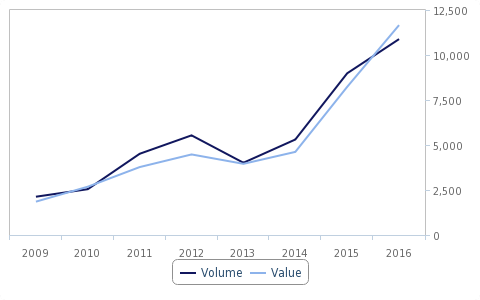

Although these global brewers have manufacturing and production plants within India, we note that India is also beginning to import more beer from overseas. Global imports of beer grew by 21% y-o-y in 2016 (latest available data) in volume terms, amounting to 10,800 tonnes. In the space of two years (2015 and 2016), the volume of beer imported in to India has doubled.

We note that European beers have driven this growth, notably from Belgium. Beer imports from Belgium accounted for 34% of total imports of beer in 2016, up from 14% in 2012. Amid growing popularity of Belgian beer, premium Belgian beer brands including Chimay and Delirium announced plans to enter the Indian market in November 2017, which is distributed by Hema Connoisseur Collections.

Huge Growth In Beer Imports

India - Total Beer Imports By Volume (Tons) And Value (USD '000)

Source: Trade Map

While India presents considerable opportunities for global beer companies, we note that India is a high-risk high-reward market for alcoholic drink producers. The country ranks in seventh place out of 18 countries in Asia and in 29th place out of 101 countries globally with a score of 60.6 out of 100 (higher score = more attractive market) in our Q218 Alcoholic Drinks Risk and Reward Index (RRI) (see 'Asia Alcoholic Drinks: South Korea Maintains Lead While Australia Moves Up', January 17, 2018). We highlight that India's overall score is dragged down by a low Industry Risk score, due to the country's comparatively poor regulatory environment and lack of retail formalisation.

Government regulations in particular pose a significant risk to the overall alcohol market in India, including for beer. For example, in April 2017, the government imposed a ban on the sale of liquor within half a kilometre of state and national highways. Bars and restaurants have however found ways to skirt around this ban by constructing mazes to increase the "motorable distance" between bars and the highways while in the city of Gurgaon, roads have been barricaded to achieve the same effect. Furthermore, more states are considering becoming “dry-states” (where the sale of alcohol is illegal except through on-trade sale), with Madhya Pradesh the latest to become a “dry-state” in April 2017. Others states likely to join are Chhattisgarh and Kerala. More recently, in February 2018, various state governments have been hiking duties on liquor with the Karnataka government announcing plans to increase taxes by 8% while Gujarat is also likely to increase excise duty on liquor sold through permitted shops to 100%, up from 50%.

Comments