Start 14-Day Trial Subscription

*No credit card required

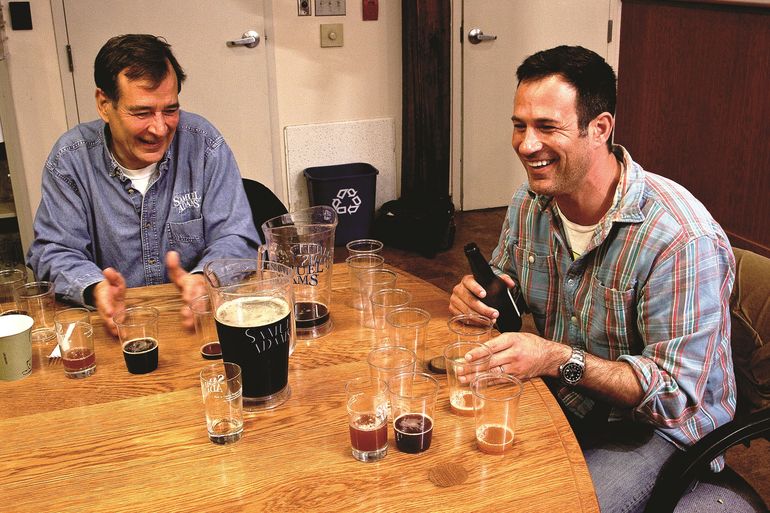

Jim Koch & Sam Calagione Talk 2020 Trends

When The Boston Beer Co. and Dogfish Head Craft Brewery announced their merger in the summer of 2019, it came as seismic news in the craft brewing community. While mergers are common occurrences in a craft landscape pockmarked with acquisitions, the two names involved were heavy hitters: Jim Koch of Boston Beer and Sam Calagione of Dogfish Head.

With 2020 upon us, we sat down with Koch and Calagione to discuss the pending trends for the new year as well as to reflect on what the year 2019 meant for the industry. The brewing giants provided plenty of insight on what proved to be an interesting year for the industry.

Though their companies’ merger was a major topic of discussion, the two legendary brewers also delved into the overall industry picture while providing some ideas about future collaboration and innovation in their own companies – and within the industry at large.

“Not only are Dogfish Head and Boston Beer two original American breweries, but Jim Koch and I worked hard with other leading craft brewery founders and the Brewers Association to develop and champion what defines independent American brewers. This merger better positions Dogfish Head and our co-workers to continue growing within this definition for many years to come,” Calagione said in a release after the announcement of the merger.

Both figureheads were happy to discuss the striking similarities between their two companies as well as what 2020 will bring for them.

What are 2-5 of the biggest beer trends consumers can expect in 2020?

Sam Calagione: The biggest trend consumers will experience in 2020 is lower-calorie, lower-carb craft beers that still feature interesting flavors. This movement is something that really caught fire in 2019, and I think we’re going to see even more options next year. With millennial drinkers so focused on maintaining active, balanced lifestyles that include both exercising and enjoying flavorful, well-differentiated craft beers, the lower-calorie, lower-carb area is simply one that brewers cannot overlook. Beyond that, Hazy IPAs are not going away and sour, wild beers will continue to rise in popularity in 2020. On a percentage basis, sours are growing faster than IPAs, and Dogfish Head SeaQuench Ale is now the best-selling sour beer in America.

Jim Koch: I think we’ll also see brewers push the boundaries of beer to challenge drinkers’ expectations and stand out on the crowded shelves. Whether through ingredients or brewing methods, these unique ways of attracting consumers can entice people to experiment with an unknown small brand or reappraise legacy brands.

Are there too many beers in the market today? Is beer selection saturated? Is this good or bad for the consumer?

Jim: As a brewer and a beer drinker, I’ve always said: there can – and never will be – enough beer. We are at a point where we’re back to pre-Prohibition numbers of breweries, but only so many have the bandwidth for distribution beyond taprooms. This is contributing to the loyalty dilemma but helping to keep craft beer alive among discerning drinkers.

Sam: There is an abundance of choice for consumers, which can be both good and bad. It’s good because folks can go out and explore all kinds of beery goodness! It’s bad because consumers often cannot tell where their beers are coming from or who is making them. Many international conglomerates have blurred the lines between the various brands they market as craft beers, putting the identity and integrity of the independent craft beer community and our products at risk.

How has the success of hard seltzers and cannabis impacted the beer industry , and how is it impacting beer companies ’ business decisions in 2020?

Sam: I do think both have an impact on overall beer sales. I think strong craft beer brands can grow in this challenging environment with the right focus on innovation, being well-differentiated and being militant about quality and consistency.

Jim: Who would have thought a few years ago that The Boston Beer Company would play in hard seltzer? Truly was an innovation we explored as an alternative for drinkers – and we’re happy we took the chance on it when we did as one of the first to market. We know hard seltzer isn’t the only alcoholic beverage drinkers choose, but more and more, drinkers are looking for great-tasting and refreshing options that aren’t high in calories, sugar or carbs, which is exactly where Truly fits. We’ll continue to innovate within this lifestyle space with beers like SeaQuench and Slightly Mighty, but in the past two years, the hard seltzer category has grown more than 830 percent and more than 220 percent in 2019 alone. Hard seltzer sales have now surpassed all IPA sales, one of craft beer’s most popular styles, demonstrating the shift in drinker preference, which Truly is capitalizing on.

Considering the popularity of craft beer, most consumers don’t realize that wine continues to outperform beer in terms of gross sales. Why is this happening and how can the beer industry overcome this trend?

Sam: At Dogfish, we have always been focused on making beers that are as complex and food-friendly as the world’s finest wines. Also, there is far more diversity in flavor, styles and ingredients in the beer world than there is in the wine world. As a community of breweries, we collectively need to do a better job promoting these facts and benefits to consumers.

Can you tell us about BBC’s decision to participate in the controversial Beer Growth Initiative ’s #BEERSTOTHAT campaign in 2020? MillerCoors and Heineken elected to not participate . What are the compelling reasons for BBC to support it?

Jim: I had a glimmer of hope when I started Samuel Adams that I was onto something great when it came to charting the course for other American craft brewers. Since then, we have allocated significant resources to supporting the beer industry and breweries of all sizes because when it comes to growing our category, we can only help ourselves. BBC has strong and longstanding relationships with industry associations like the National Beer Wholesalers Association, the Brewers Association and the Beer Institute and when we join forces with competitors to fuel campaigns like #BEERSTOTHAT we’re illustrating our shared purpose in elevating and celebrating beer to fuel the category.

How is the Dogfish merger strengthening The Boston Beer Company’s position within the industry?

Sam: Together, Dogfish Head and The Boston Beer Company have a wide-stretching portfolio of craft beers and beyond that are sure to better position our collective company to compete with craft beverage makers everywhere, including those large, international conglomerates that are nearly fifty times our size. While our newly merged collective may be the largest independent craft brewer in the country, we are still less than three percent of the U.S. beer market share. So, we are still a David fighting the same dominant, international Goliaths that control more than 80 percent of our country’s beer market. Our individual portfolios pre-merger were great, but when put together, we’ve really got an unstoppable force of unique, well-differentiated (yet totally complementary) high-end beverages. With our Dogfish Head brand, we tend to focus on IPAs and sours, incorporating culinary ingredients just as we did when we opened as the smallest commercial brewery in America 24 years ago. We also have a fun little growth engine in our distillery.

Jim: Samuel Adams focuses more on lagers and traditional beer styles while expanding into “beyond-beer” categories with Twisted Tea hard iced tea, Angry Orchard hard cider, Truly spiked seltzer and other innovation brands including Tura hard kombucha and Wild Leaf hard tea. To Sam’s point, our various offerings are perfectly complementary and not competitive within the portfolio. In fact, the diversity of products and the strength of our combined team allows us to continue to innovate, learn from, adapt to and anticipate drinker habits. We are growing double digits in a flat market and are poised to grow double digits again next year as a singular entity.

What have been the biggest challenges in merging the two companies?

Jim: The merging of Dogfish Head and The Boston Beer Company has been very smooth. We announced our plans in May, officially closed in July and shared our first combined financial results in October. We look forward to closing out 2019 strong and entering 2020 as a singular, powerful entity.

Sam: It has been amazing to see just how similar our companies are; our cultures, our co-workers, our wacky and off-centered traditions. We think alike, we work alike, and we have the same core values. Honestly, the most challenging thing has been (and continues to be) getting all of our systems aligned including IT, distribution, inventory, sales programs, etc.

What innovation and collaboration can we expect from the Samuel Adams and Dogfish Head brands in 2020?

Jim: The sky is the limit, and innovation is always a priority for our team. A great idea can come from anyone and anywhere. With the addition of our Dogfish Head co-workers, we have even more brainpower to foster collaboration and great ideas across our network. I’m excited about what’s to come from this talented group in the new year.

Sam: There’s the release of Dogfish Head’s classic World Wide Stout aged in used Utopias barrels from Sam Adams. We officially announced this collaboration a couple of weeks ago at the Great American Beer Festival, and I could not be more excited for the beer to debut in March! Other than that, there are no specific collaborations in the works, but we are really looking forward to continuing business as a singular entity in 2020. It will be awesome having the opportunity to continuously collaborate, innovate and bounce ideas off one another to create topnotch craft beers and beyond.

If Jim were to fully retire from BBC, is Sam the best candidate to fill Jim’s shoes? If so, what qualities does Sam possess that make him ideal to become the face of BBC’s beer portfolio?

Jim: While I’m sure Sam would look great in my black leather shoes, I’m not going anywhere anytime soon. We have a tremendous executive leadership team including Dave Burwick, who was appointed CEO in 2018. As Dave focuses a bit more of his time on operations, finance, HR and legal, Sam and I can focus on brewing, culture and sales to live up to our respective titles of founders and brewers.

Sam: I am proud to have the same title as Jim – we are founders and brewers with our brands – and love the work we get to do every day. I am looking forward to working with all of my fellow BBC co-workers to grow all of our brands, and I believe my role and title will stay what it is today for many years to come.

Jim, what is your favorite Dogfish Head beer? Sam, what is your favorite Samuel Adams beer? What differentiates that beer to you?

Jim: I’d have to say 60 Minute IPA because it’s a unique and very creative take on a beer that has become a standard for craft brewers. The continuous hopping method is a differentiated brewing philosophy that I can appreciate – much like my own lager-brewing technique.

Sam: My favorite Sam Adams Beer is Boston Lager. It was one of the first beers I snuck out of my dad’s fridge in high school and for 24 years, whenever I travel to faraway places and am stuck in airports that don’t serve Dogfish, I can usually find Boston Lager and it is always fresh, consistent and delicious.