Start 14-Day Trial Subscription

*No credit card required

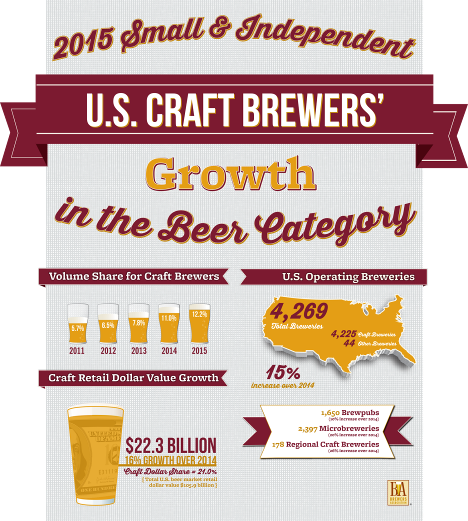

Small and Independent Craft Breweries Still on the Rise

The Brewer's Association has released its annual figures on US craft brewing growth, citing double digit growth across the board. Craft breweries reached the highest-ever volume in the US last year, at 4,269, 15 percent higher than 2014. That, coupled with a 13 percent rise in production, and a 16 percent increase in retail dollar value, has those in the industry smiling, with good reason – the craft beer job market is also on the rise – up to 122,000 jobs, 6,000 more than last year.

"For the past decade, craft brewers have charged into the market, seeing double digit growth for eight of those years," said Bart Watson, chief economist, Brewers Association. "There are still a lot of opportunities and areas for additional growth. An important focus will remain on quality as small and independent brewers continue to lead the local, full-flavored beer movement."

Read the full press release below.

Small and Independent Brewers Continue to Grow Double Digits

Brewers Association Releases Annual Growth Figures for American Craft Brewers

Boulder, CO • March 22, 2016—The Brewers Association (BA), the trade association representing small and independent1 American craft brewers, today released 2015 data on U.S. craft brewing2 growth. With more breweries than even before, small and independent craft brewers now represent 12 percent market share of the overall beer industry.

In 2015, craft brewers produced 24.5 million barrels, and saw a 13 percent rise in volume3 and a 16 percent increase in retail dollar value. Retail dollar value was estimated at $22.3 billion, representing 21 percent market share.

"For the past decade, craft brewers have charged into the market, seeing double digit growth for eight of those years," said Bart Watson, chief economist, Brewers Association. "There are still a lot of opportunities and areas for additional growth. An important focus will remain on quality as small and independent brewers continue to lead the local, full-flavored beer movement."

Download High Resolution Graphic Here

View Expanded Infographic Here

Additionally, in 2015 the number of operating breweries in the U.S. grew 15 percent, totaling 4,269 breweries—the most at any time in American history. Small and independent breweries account for 99 percent of the breweries in operation, broken down as follows: 2,397 microbreweries, 1,650 brewpubs and 178 regional craft breweries. Throughout the year, there were 620 new brewery openings and only 68 closings. One of the fastest growing regions was the South, where four states—Virginia, North Carolina, Florida and Texas—each saw a net increase of more than 20 breweries, establishing a strong base for future growth in the region.

Combined with already existing and established breweries and brewpubs, craft brewers provided nearly 122,000 jobs, an increase of over 6,000 from the previous year.

"Small and independent brewers are a beacon for beer and our economy," added Watson. "As breweries continue to open and volume increases, there is a strong need for workers to fill a whole host of positions at these small and growing businesses."

Note: Numbers are preliminary. The Brewers Association will release the list of Top 50 craft brewing companies and overall brewing companies by volume sales on April 5. Additionally, a more extensive analysis will be released during the Craft Brewers Conference & BrewExpo America® in Philadelphia from May 3-6. The full 2015 industry analysis will be published in the May/June 2016 issue of The New Brewer, highlighting regional trends and production by individual breweries.