A Look at the SIBA Q3 UK Brewery Figures and Paths to Boosting Sales

Exploring New Strategies, UK Breweries Tackle Sales Challenges in 2024 to Attract Customers and Sustain Growth in a Competitive Market.

In the UK, beer is big business. Through 2024, it’s expected that some 3.7 billion litres of beer will be sold across licensed establishments and directly for home consumption, with a significant portion of the out-of-home sales being driven by the summer’s UEFA Euro 2024. Still, even without a major international tournament, beer consistently sells well in the UK.

Over the years, interest in independently-brewed beers, real ales, and the like has seen an increase, with people wanting to try beer beyond your stock labels found behind the bar and in supermarket aisles. The demand was enough to encourage many people to get into the brewing business, but we’re now seeing a significant retraction. So, how much has the independent brewing scene shrunk, and what can brewers try to avoid joining the departures list?

A Year of Brewers Bowing Out

In the independent brewing scene, if the first three quarters of the year are anything to go by, 2024 will be defined by the number of breweries that left the scene. According to the figures from SIBA, which you can see on this page, 2023 saw its brewery count remain relatively level with a net loss of 13 brewers. One quarter saw an overall increase of two breweries, while the others showed a decrease of four, nine, and two breweries.

Come into 2024, and the rate of decline accelerated a great deal. The Q1 figures point to a loss of 38 breweries to a count of 1,777 in total. In Q2, the amount going out declined, but still clocked in at 29. Finally, SIBA’s most recent figures, which date June to September 2024, report a further 27 breweries bowing out. It leaves a total of 1,721 independent breweries that are still active in the UK – a loss of nearly 100 on 2023’s Q3 count of 1,817.

Breweries Battling Back

Many independent breweries around the country have started to take action to avoid joining the departures list. Offering brewery tours with sampling along the way has become very popular, but that does still only reach so far. Not too many people would cross the UK for a brewery tour, after all. With many now operating their own online stores featuring their own products, more marketing opportunities should be leant into.

When shopping online for just about any product, the vast majority of customers look for ways to get a bonus or a discount. Some stats point to over 90 per cent of shoppers regularly searching for a voucher before purchasing. In fact, in any competitive online sector, boosts are regularly found. Just by clicking here, you can see how many iGaming platforms rely heavily on having appeal through bonuses like ten days of spins or no-deposit bonuses.

To increase sales and encourage customers to come back, breweries could use similar methods. Offer vouchers for money off to people with new accounts and highlight that those who sign up for marketing emails will also receive regular bonus codes to use when buying beer. It all helps to get customers and keep them there. On top of this, making the most of social media is becoming essential.

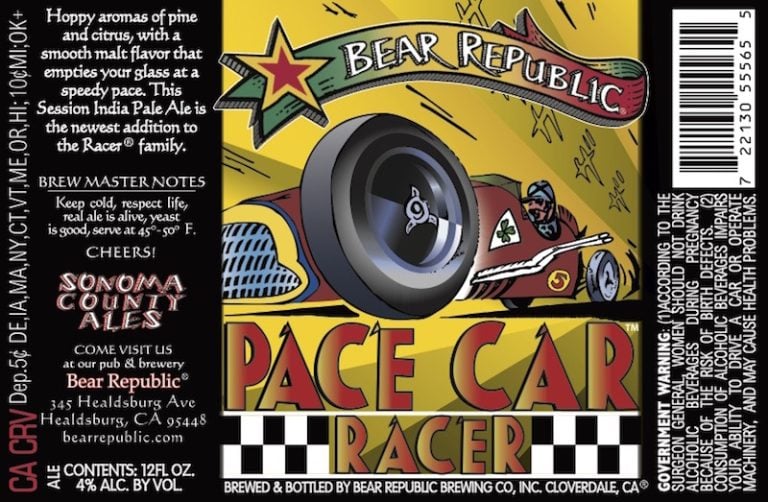

Now, any business can just post images and videos of their brewing process and the final beers to TikTok, Facebook, Instagram, and the like, so the key is to stand out. Craft beers with humorous or at least intriguing names, and invest in memorable, eye-catching designs for the cans or bottles. A prime example of this working is with the Mitchell Brewing Co. earlier this year, whose lager went viral just for its name and label artwork.

To stop the rot, breweries should look into how they can leverage web stores and social platforms to encourage more purchases, retain customers, and get the word out about their latest and greatest beers.

Comments 0

No Readers' Pick yet.